Gross Vs Net – Differences and Similarities

Gross stands for the revenue generated from a business entity during a specified timescale, which could be revenues for a month or a year as well. But the net part? Are these two different? You just have to read on to get the needed answer.

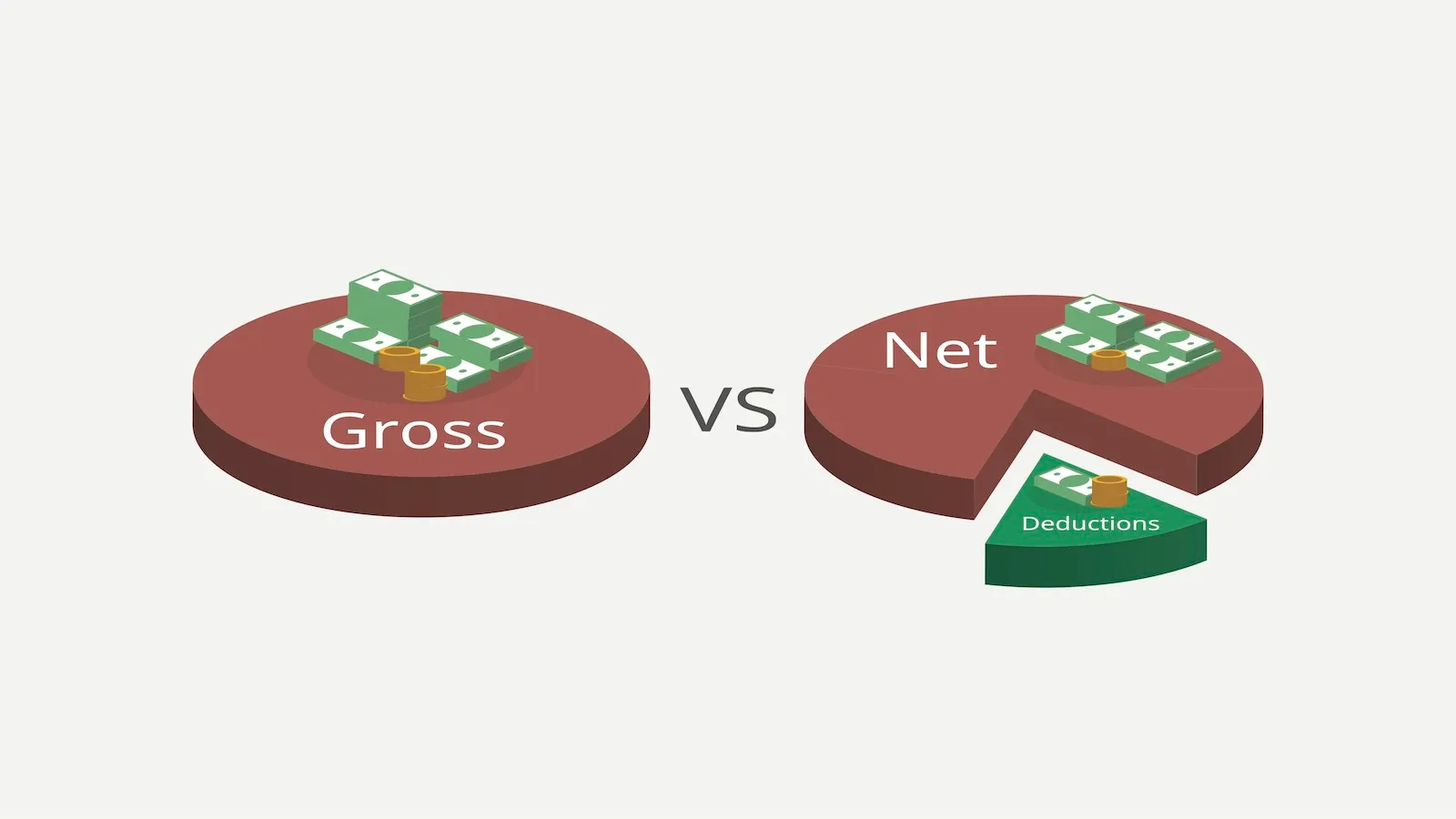

“Gross” and “Net” are words used in financial analyses to represent distinct concepts of income or revenue. Here’s a simple explanation of their differences and similarities:

1. Gross: This term means the overall quantity of something. To illustrate, gross income is the full amount of money you receive before the government deducts taxes or finalizes any deductions.

Also, we can see the gross profit which is the income from the sales that was made before minimizing the expenses to the cost of goods sold.

2. Net: is defined as the portion that is left over after payroll deductions and allowances have been subtracted from the gross amount.

Let’s say that net income is your money left after taxes and other levies are removed. Profit after all deductions when you subtract from the amount due not only direct costs by the cost of goods sold, taxes, and operating expenses.

Gross and net share the identical attribute that they are both numbers in monetary format. But then, gross is the total price before deductions while the net is the amount after deductions.

Lastly, it is profit, the starting point for computing it is gross, and expenses or reductions are not what you end up with after accounting for expenses or reductions, generally referred to as gross to net.

What Does Gross Mean?

Gross which, without taking into consideration the deductions and subtractions, means the total or complete amount.

In financials, it may stand for an income or profits before tax deductions or other expenses that are subtracted from it.

For example, gross income is defined as the total amount of directly-gained money without deducting contributions or taxes.

There is also gross revenue, which is all product sales results preceded by the cost of goods sold, which includes all materials and human resources expenses.

Is Net Entirely Different?

By the term “Net” we mean the quantity left over after deductions or expenses are taken away from the gross amount.

Another aspect is income after tax which is your earnings minus the amount of tax you paid and other things like insurance and social security that are deducted from your salary every month.

The net profit is the total sum of money you have remaining after subtracting the expenses, including the cost of goods sold, taxes, and operating costs, from the total revenue that you earned in your business.

Conclusion

In the financial world, “gross” and “net” are just being one small stage to another stage of income or earning.

“Gross” does not include any deductions or expenses whatsoever and is determined before any subtraction. It may be a gross income before taxes, a gross profit before subtracting costs, or any kind of income before allowing for some deductions.

“Net,” is referred to the amount after deductions or expenses have been subtracted from the original gross number.

It’s what you get after you’ve removed whatever is outside the group, like net income after deducting any tax costs or costs after you deduct all expenses.

The distinction between the gross and the net is that the gross is the amount being deducted from the latter. They are related in that the net is a result of reducing gross by traffic through deductions.

The bottom line is gross tells you the whole story, and net tells you the amount that you bring home taking into account taxes, social security, and any other deductions.

CSN Team.