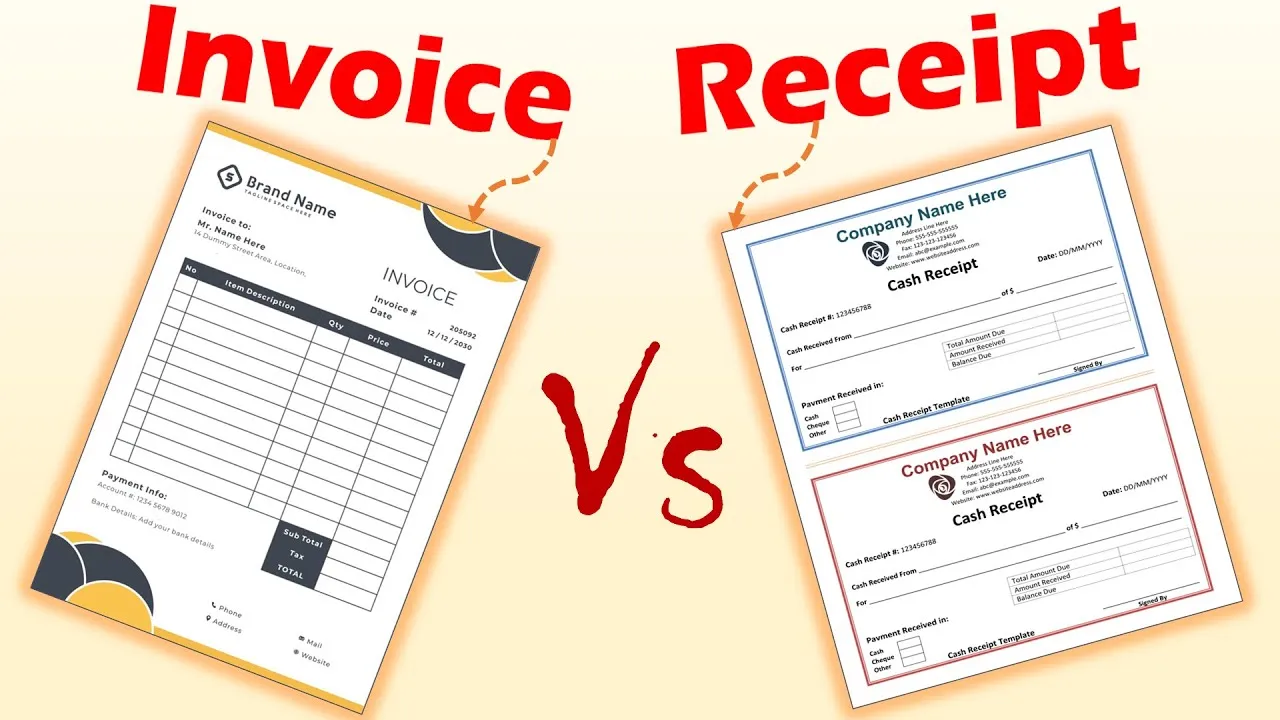

Is there a Difference Between Invoice and Receipt?

An invoice is an edict presented to a client by a trading party for the reason of allowing the completion of a sale. It contains the information on the Goods and has the names of the parties as well as the location of the parties and parties’ representatives.

As it turns out, what is an invoice and receipt differ. An invoice is a document that sellers send to buyers so that the latter can see the items or services they purchased and their price(s).

It’s like a receipt that indicates the buyer is spending what they owe. While a receipt is a document that the seller gives to the buyer, a receipt is given by the seller once the payment has been made.

It depicts evidence of payment, and it normally includes such information as the date of the transaction, the amount transferred, and what item has been paid for.

In other words, an invoice and receipt must be considered as a part of the documented financial accounting cycle.

What is an Invoice?

An invoice is a document that tells you the amount of money you owe for what equity or services you consumed.

Here, you can see how much does each one costs, and the total you’re supposed to pay. This thing is so cool.

So, imagine it as this shopping list with money attached that the woman brings to you when you’re wondering what you should pay.

Is a Receipt an Exception?

No. A receipt is not an exception, but a common document issued to the purchaser for after-service.

The receipt granted to you, when having a product or service I paid for, is the main evidence of payment. It shows your order details such as what you bought, how much you paid, and when the payment was made.

Treat it as a sneak peek through a turnstile after that point of entry where you paid. Such a label attests to the fact that you have the authority to enter the building by way of due payment of the equivalent fee.

Also, receipts are not luxury or superfluous things because they serve the purpose of helping you with the control of purchases and the tracking of spending.

Are Invoices of Proofs of Payments?

Invoices are the lily pads opposite the pay-the-bill post. They are the approvals rather than the payments.

When you buy something or use a service, the seller fights every legal invoice that he sends to you – that will be the total balance of the account.

While they (receipts) serve as proofs of payment, sometimes they can also be forged. They are reserved for your order once you have paid for goods and services.

Upon receipt, a document containing evidence of your payment would indicate that it has already been paid, as well as provide further information detailing the date of payment, what you bought, and how much you paid.

Thus, you have to take a wait-and-see position when it comes to invoices since they show that you owe, but receipts come to the rescue by showing that you have made the payment.

Not only of these documents fundamental for making recordings of your purchases and payments history but also are key to keeping track of all your expenses.

What Makes a Receipt Valid?

When it comes to receipt, important details like store name, date of purchase, and client’s contact information must be available. Firstly, it should have the name, as the store or company from which you bought anything.

After that, it’s worth noticing that you include your name and address or at least some identification in the letter to show that it’s a letter from the sender. That means you have to precisely the date when the transaction happened.

Secondly, the main advantage is that the receipt allows you to see exactly what you paid for and what you purchased, including clear descriptions written down with the particular prices for each of them.

As well it also should show your total amount in numbers and words of the payment done, thus there should be no confusion.

It allows you to do a tracking and record all your payments, you can quickly present the proof of such payment, and this will be valid if you need returns or exchanges

Conclusion

What distinguishes an invoice and a receipt is the fact they are two separate documents where the first is used to record payments made while the latter is a confirmation of payments received from a customer.

An invoice gives you an idea of what money you should pay before making a payment. It may involve, an inventory list of products or services, their prices, and the total amount due.

Then, there’s a receipt given after you have paid which shows, in turn, that you have paid when you make a purchase. Itemized listing encompasses the following details: date of transaction, what you purchased, price paid, and seller details.

CSN Team.