How to Transfer Money Using the FCMB Mobile Money Code

The FCMB Mobile Money transfer code has made the customers regard the bank as their best and has aided them in building enduring bonds with the customers. This feature makes it possible to use your cell phone for money transfers within the Nigerian banking system.

It is also important for you to note that you will only be in a position to make a USSD Transfer using the bank’s code when your number has been registered for mobile money transfer.

How to Use the FCMB Mobile Money Code

The number you used when opening the account was activated for FCMB Mobile Transfer. But then, to transfer money using the FCMB (First City Monument Bank) Mobile Money Code, follow these simple steps:

1. Dial Code: Do this with your phone just dial *329# to access the FCMB Mobile Money Code services.

2. Select Transfer: Simplify the instruction by using word and phrase substitutions for example: “Choose money transfer as the option you want to select from the screen displayed in front of you”.

It is usually presented as “Transfer Funds” or something else so that you can transfer the money between your accounts.

3. Choose Account: Identify the account from which you want to initiate the transfer. ‘If you have many accounts to your FCMB Mobile Money code, click the account that you desire to fund.

4. Enter Recipient’s Details: Enter the beneficiary bank details, the amount you would like to transfer and for whose account is the money intended. Make sure that the information is right by carefully verifying each detail.

5. Confirm Transaction: Review transaction details including the account number of the recipient and the amount that appears. Ensure every detail is the right one and make sure before proceeding next.

6. Enter PIN: Please enter your FCMB Mobile Money Code PIN to authorize transfers initiated. That is saying, a PIN is a form of safeguard that is created to keep your account.

7. Transaction Completion: As a result the authorization and settlement of the transaction will finish with a confirmation message on your phone saying that the fund transfer was successful.

8. Save Confirmation: It’s advisable to save the confirmation message for your records, especially the transaction reference number, in case you need to reference it later.

Remember to ensure you have sufficient funds in your account and that you are entering the correct recipient details to avoid any errors or complications during the money transfer process using the FCMB Mobile Money Code.

What is the FCMB Transfer Code?

FCMB (First City Monument Bank) Transfer Code is a service detailed by its efficiency and user-friendly features that help customers access different banking activities directly from their phones.

This is easy as all it needs is dialing *329# on your device and you’ll be offered a range of banking services, including:

1. Money Transfers: This transfer is seamless as customers can easily and conveniently transfer funds from FCMB accounts to other accounts to other banks in Nigeria. They have their service round the clock which can be done anywhere you are at any given time.

2. Airtime Recharge: The FCMB Transfer Code is not only for customers to perform simple airtime recharges, but it also allows them to recharge airtime for their loved ones, friends, and even themselves, directly from their bank accounts.

3. Bill Payments: The customers of this company can use the code to pay for bills such as electricity bills, cable TV subscriptions, and utilities among other bills easily to save time and money in cash handling.

4. Balance Inquiry: For example, customer service cannot be underestimated. The customers just call the coded number to check the real-time account balance, so that they will know the accurate assets they hold.

5. Mini Statement: Consumers could, in addition, have the recent transactions statement sent to them via the FCMB. This would then give them a summary of the activities on their account.

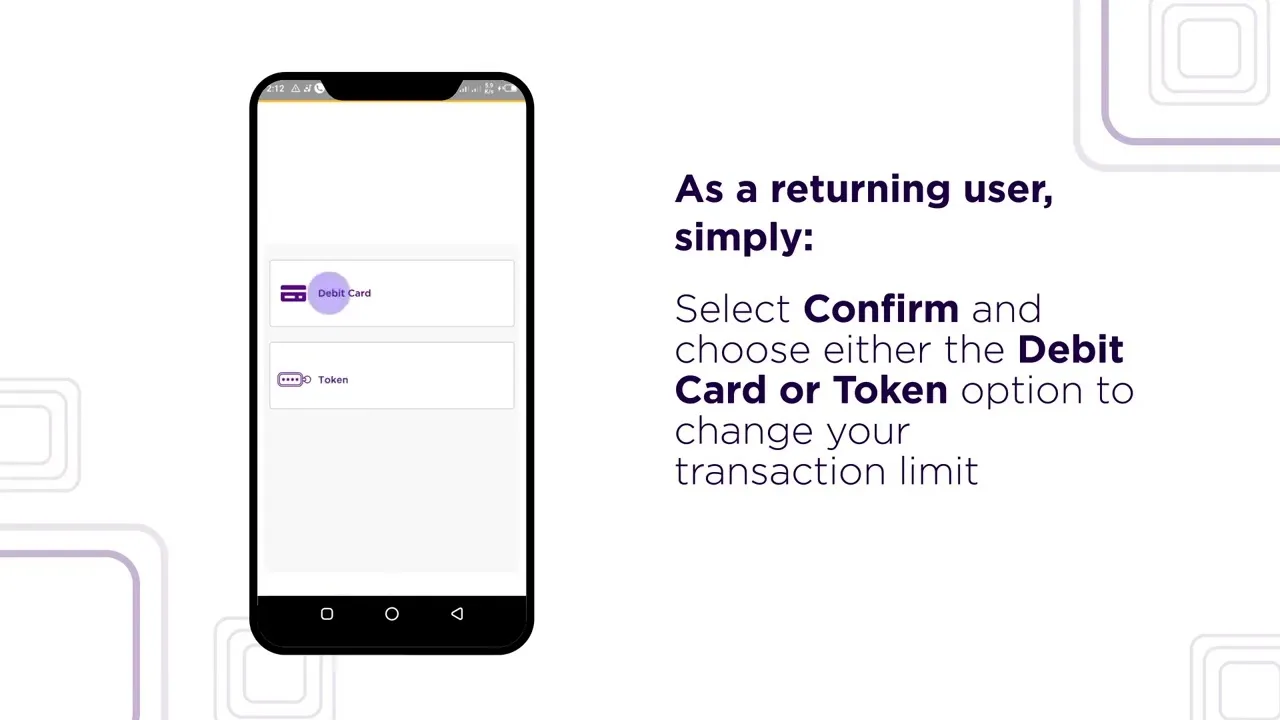

6. Account Management: The code used here enables the customers to alter their profile elements such as personal information, transaction value constraints, and others.

7. Security: Probably the most crucial factor for the SMS or USSD FCMB- Transfer Code is the security aspect, and for this reason, all transactions must be confirmed or authenticated using a unique Personal Identification Number (PIN).

It’s correct that you can raise your transfer limit on your FCMB account but usually, you will have to either contact the bank management directly or apply online through the official site of First City Monument Bank.

Can I Increase My FCMB Transfer Limit?

Yes, but this has some methods. This FCMB Transfer Code contributes towards improving banking convenience for individual customers as it removes the barrier of internet connectivity besides the time consumption of traveling to traditional banks and long queues.

These are replaced by a fast, secure, and convenient way of performing various transactions from the comfort of their mobile phones without the hassle of internet access or visits to physical bank branches.

Here’s how you can go about increasing your FCMB transfer limit:

1. Contact FCMB: A customer can always contact FCMB representatives through phone calls, e-mails, or by personally visiting an FCMB branch. Outline for your future message could be: admitting that a larger amount of money needs to be transferred and if so, provide any requested details.

2. Use Online Banking: If you have access to the FCMB online banking system or the right mobile app, you will be able to log in and navigate to the settings or profile section. Explore other options as available in some accounts where there could be a limit increase request facility.

3. Follow Instructions: Take any piece of instruction that has been given to you by FCMB and carry out every step of it, which may include verifying your identity, providing additional documents, and agreeing to some terms and conditions.

4. Wait for Approval: The bank will need to look into your request and decide if the limit will be raised. This is a step-by-step process therefore please do not rush it either way, just wait for them to come and engage in a conversation.

5. Confirm Increase: The FCMB will immediately authorize your request and will inform you of the designated limit for the account transfer. Then, you will proceed to conduct money transactions using the refined limit.

The upper limit, like this, is subject to your account type and banking relationship with you as well. So, it is super suggested that you reach FCMB immediately directly to get concrete information and firm guidance on raising your transfer limit.

CSN Team.